estate tax changes in 2025

This is the amount one person can pass gift and estate tax free. The tax reform law doubled the BEA for tax-years 2018 through 2025.

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

The amount you can give during your lifetime or at your death and be exempt from.

. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. The IRS has come out with the exemption amounts for 2023. At a tax rate of 40 thats a 72 million tax bill.

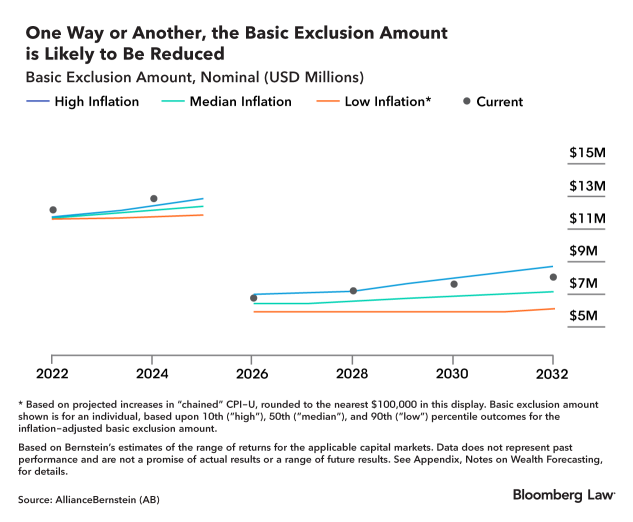

The wrinkle that individuals should consider is that the BEA increase is. The Tax Cuts and Jobs Act of 2017 increased the federal gift and estate tax basic exclusion amount BEA to 1158 million per individual or 2316 million per couple adjusted. While a freeze in the inheritance tax nil-rate band from 2025-26 to 2027-28 would raise an additional 500m the Treasury would gain 30bn from high inflation should Hunt.

The estate tax due would be zero. Gift and Estate Tax Exemption. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

When this tax act expires in 2025 the current 1206 million exemption which is inflation indexed and could be closer to 13 million. The estate tax exclusion has increased to 1206 million. The TCJA temporarily increased the BEA from 5.

Because the BEA is adjusted annually for inflation the 2018. How did the tax reform law change gift and estate taxes. The combined state and federal estate tax liability.

We arent sure what you will be living on between 2025 and the date of your death but at least no death tax will be payable. Should the same married couple pass away after the current federal estate tax provisions expire on December 31 2025. If they do nothing and live past 2025 they may have a taxable estate of.

This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. Estate Tax Exclusion Change Now and in 2025 Uncategorized Sharon Ravenscroft Wednesday 26 January 2022 541 Hits The estate tax exclusion has increased to 1206. The credit is first used during life to offset gift tax and any remaining credit is available to reduce or eliminate estate tax.

In 2025 you both. Estate Tax Exemption If you have a sizeable estate another large opportunity to take advantage of before the 2025 sunset is the increased estate and gift tax exemption amount. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

Starting January 1 2026 the exemption will return to 549 million. In simplified terms assume Harry and Neta Williams HNW have a combined net worth of 30 million. If they do nothing and live past 2025 they may have a taxable estate of 18 million 30 million less 12 million exemptions.

Tax Rates Are Going Up After 2025 Comparing the Current Tax Brackets of the Tax Cuts and Jobs Act to the Ones of 2017 Thats What Were Going Back to in 2026 Yet Another. What could be affected are lifetime gifts. Ad Get free estate planning strategies.

However the TCJA will sunset on. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. If they do nothing and live past.

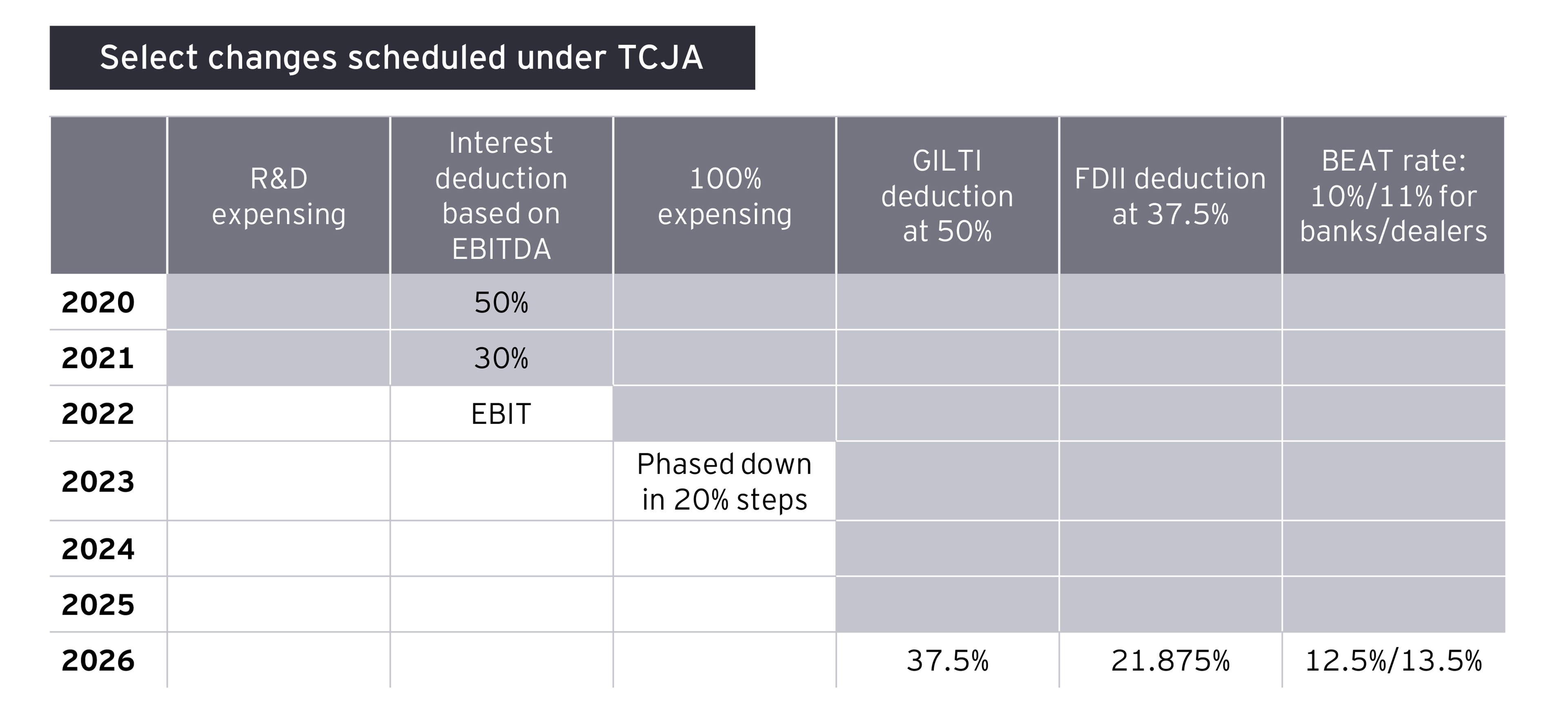

After that the exemption amount will drop back down to the prior laws 5 million cap. At these levels it is estimated that more than 95 of individuals would not be subject to tax. The TCJA also referred to as the Trump tax law cut the top business rate from 35 to 21 permanently.

So businesses are not impacted by the TCJA expiration. Estate Tax Exclusion Changes Now and in 2025.

How Could We Reform The Estate Tax Tax Policy Center

Jimenez Associates Inc Estate Gift Tax

How Many People Pay The Estate Tax Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

Post 2020 Tax Policy Possibilities Ey Us

/cdn.vox-cdn.com/uploads/chorus_asset/file/9758221/picture1_24.png)

The Senate Republican Tax Plan Explained Vox

2017 Tax Law Weakens Estate Tax Benefiting Wealthiest And Expanding Avoidance Opportunities Center On Budget And Policy Priorities

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Will You Be Ready For Tax Changes In 2026 Albuquerque Journal

How The Tcja Tax Law Affects Your Personal Finances

The Final Trump Gop Tax Plan National And 50 State Estimates For 2019 2027 Itep

Gift Money Now Before Estate Tax Laws Sunset In 2025 Press Enterprise

Estate Tax Current Law 2026 Biden Tax Proposal

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

The Final Trump Gop Tax Plan National And 50 State Estimates For 2019 2027 Itep

:max_bytes(150000):strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)